nebraska sales tax rate changes

Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. Sales and Use Taxes.

025 lower than the maximum sales tax in NE.

. A new 05 local sales and use tax takes effect bringing the combined rate to 6. The city of Wood River will start a new local sales tax at the rate of 15 and the city of Geneva will increase its local sales tax rate from 15 to 2. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

It has changed 13 times since then and is now 55 percent 6. Nebraska Sales Tax Rate Finder. The corporate tax rate for the first 100000 of Nebraska taxable income remains 558.

There are no changes to local sales and use tax rates that are effective July 1 2022. Several local sales and use tax. Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax bringing the total sales and use tax rate in each city to 65. Effective October 1 2002 the state sales and use tax rate has increased to 55 up from 50.

A temporary rate change has been established in the state of Nebraska. Motor Fuels Tax Rate. New local sales and use taxes.

For tax rates in other cities see Nebraska sales taxes by city and county. Local sales and use tax drops by 1 bringing the combined rate to 55 the state rate. We provide sales.

Simplify Nebraska sales tax compliance. Average Sales Tax With Local. 18 rows Raised from 55 to 6.

This study recommended that business-to-business sales or business inputs be exempt a structural principle that still exists in todays law that is supported by economists as a sound tax policy 5. For tax rates in other cities see Nebraska sales taxes by city and county. The new local sales tax rates are effective April 1 2016.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Returns for small business Free automated sales tax filing for small businesses for up to 60 days. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state.

Nebraska rate change. Edward will increase by 15 bringing the combined rate to 7. 05 lower than the maximum sales tax in NE.

There is no applicable county tax or special tax. There are a total of 295 local tax jurisdictions across. LB 432 reduces the corporate tax rate for Nebraska taxable income in excess of 100000 from 781 to 750 in tax year 2022 and to 725 for tax year 2023 and beyond.

The 75 sales tax rate in Geneva consists of 55 Nebraska state sales tax and 2 Geneva tax. Although many changes have been made in the sales tax since 1967 one of the most significant was the 1983 elimination of the sales tax on food for home consumption. 18 rows Nebraska sales tax changes effective July 1 2019.

Nebraska announced cities local sales and use tax changes. No credit card required. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

Old rates were last updated on 412021. Groceries are exempt from the Nebraska sales tax. A new 1 local sales and use tax is being imposed in the following locations bringing the total state and local rate in each to 65.

Hubbard is levying a 15 local tax bringing the total rate to 7. There is no applicable county tax or special tax. Nebraska Department of Revenue.

Higher sales tax than 100 of Nebraska localities. Nebraska City 20 75 075 16-339 33705 Nehawka 10 65 065 240-340 33740 Neligh 10 65 065 91-341 33775 Nelson 10 65 065 80-342 33880 Newman Grove 15 70 07 98-346 34230 Niobrara 10 65 065 73-349 34370 Norfolk 15 70 07 15-351 34615 North Bend 15 70 07 92-353 34720. Changes in Local Sales and Use Tax Rates Effective January 1 2021.

There are no changes to local sales and use tax rates that are effective January 1 2022. Sales and use tax in the city of St. The original state sales tax rate was 25 percent.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. You can print a 7 sales tax table here. You can print a 725 sales tax table here.

The Nebraska state sales and use tax rate is 55 055. You can print a 75 sales tax table here. There is no applicable county tax or special tax.

January 2019 sales tax changes Dakota City. New rates were last updated on 712021. 2018 Charitable Gaming Annual Report.

535 rows Nebraska Sales Tax. Geneva collects the maximum legal local sales tax. The following are recent sales tax rate changes in Nebraska.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The 7 sales tax rate in Waverly consists of 55 Nebraska state sales tax and 15 Waverly tax. The original rate of 50 will be reinstated on October 1 2003.

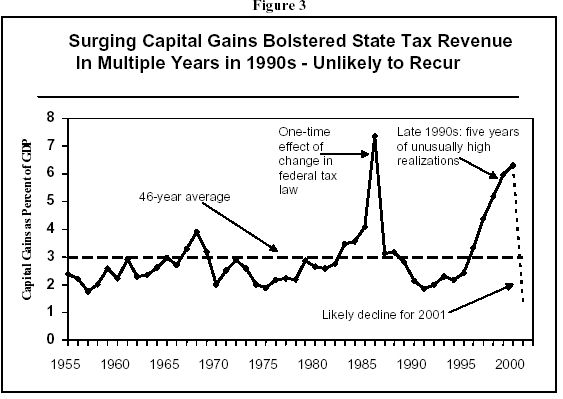

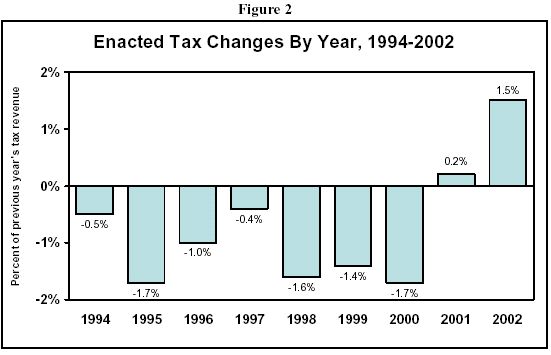

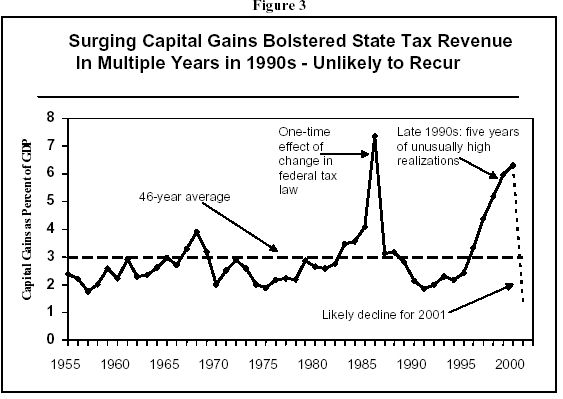

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

How High Are Cell Phone Taxes In Your State Tax Foundation

General Fund Receipts Nebraska Department Of Revenue

2020 Nebraska Property Tax Issues Agricultural Economics

How Long Has It Been Since Your State Raised Its Gas Tax Itep

The Sarpy County Nebraska Local Sales Tax Rate Is A Minimum Of 5 5

Are State Taxes Becoming More Regressive Rev 10 29 97

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Taxes And Spending In Nebraska

State Income Tax Rates And Brackets 2022 Tax Foundation

Taxes And Spending In Nebraska

Sales Tax By State Is Saas Taxable Taxjar

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation